These Are The Best Online Stock Brokers For Beginners Investor’s Business Daily

Contents:

These organizations charge commissions and fees per trade and they may provide a wide range of other services and features including research tools, educational materials, and financial advice. Each stock trading platform gives you access to a dashboard for tracking your investment accounts, types of investment vehicles, and your trades. E-trade does have small fees for options contracts and some fees involved with retirement accounts.

- SoFi Active Investing offers career coaching services and frequently hosts educational events.

- A brokerage account is an investment account that you use to trade assets online.

- Schwab offers 24/7 phone and online chat support as well as in-person support at one of its more than 300 branches across the US.

- It is not the bank advertiser’s responsibility to ensure all posts and/or questions are answered.

- Fidelity is a well-known full-service brokerage and retirement account management and remains one of the best brokers out there.

- Usually, the higher the minimum deposit required to open an account, the better the conditions in terms of spreads and commissions.

For more information and a complete list of our advertising partners, please check out our full Advertising Disclosure. TheCollegeInvestor.com strives to keep its information accurate and up to date. The information in our reviews could be different from what you find when visiting a financial institution, service provider or a specific product’s website.

#5 Best broker for beginners

Standard account offer spreads from 1 pips with no additional commission charges. The information on this site is not directed at residents in any country or jurisdiction where such distribution or use would be contrary to local law or regulation. NAGA has created an innovative and exciting platform for traders.

- If you’ll be trading via a mobile app, see what sort of reviews it has in the app store.

- So don’t expect a bailout if you see the value of your stocks or bonds decline.

- You will bear the standard fees and expenses reflected in the pricing of the investments that you earn, plus fees for various ancillary services charged by Stash.

- You can also learn from our expert traders about the difference between investing and trading, and learn here about how to become a trader.

Great brokers understand the need to promote financial literacy among their clients to help them in improving the performance of their portfolios. To achieve this goal, they make available guides, tutorials, webinars, and online conferences in which interesting topics are discussed to help investors further enrich their knowledge. The minimum investment required to open an account with most online brokers is low. In addition, this broker’s zero-fee options trading service is particularly attractive for traders who prefer to operate with derivatives rather than buying the underlying asset directly. This lets you trade everything on thesestock trading apps for beginnerslike stocks , ETFs, options and cryptocurrencies commission-free.

If you are more interested in stocks and options, Schwab offers magnificent research and reports from third party company’s including, Morningstar and Market Edge. Beginners will also love Schwabs insights section, that includes a knowledge center, insights and ideas and investing principles for those looking to get a leg-up from the start. One of the foundational realities of investing is knowing why you must start investing now. Some people approach investing casually—I’ll get to it later, but I have more pressing concerns now.

Compare the rates, best online stock brokers for beginners, and rewards of top credit cards for military servicemembers and veterans, including cards with waived annual fees under the SCRA. I have Vanguard for most of my investments, simply because I have been with them for so long and they offer everything I need. Schwab, Fidelity, and several other companies also offer wonderful alternatives to Vanguard. It is not the bank advertiser’s responsibility to ensure all posts and/or questions are answered. Ryan started The Military Wallet in 2007 after separating from active duty military service and has been writing about financial, small business, and military benefits topics since then.

Check the reporting tools on each platform to help you track how your trades are performing. Also check what tax reporting features are included to help make it easier to fulfill your obligations to the IRS. Interactive Brokers took out the top prize as the Best Overall Broker in the 2022 Finder Stock Trading Platform Awards for a number of reasons. Not only does it provide convenient access to US stocks, but it also allows you to trade stocks in over 30 countries worldwide. Interactive Brokers was founded in 1978 by Thomas Peterffy and has since grown to provide 1.9 million average daily trades to more than 2 million clients.

Best Discount Brokers and Online Brokerage Accounts

These age groups want to align their investing with their social preferences and keep good company to socialize and learn from others. Public.comis another commission-free investment app that targets Millennials and Gen-Zers who have attuned their senses to social media. TradeStation Analytics helps you find the right opportunities in real-time, get into and out of trades, and discover hidden opportunities with technical analysis.

In addition, their https://trading-market.org/ platform includes software called Recognia®, which recognizes potential technical patterns and events. Other non-trading fees include a $1 fee for withdrawals made via ACH and $10 for those made via wire transfer. Finally, outgoing withdrawals cost $25 when made via wire transfer.

OctaFX – Best for Cryptocurrencies TradingTrading 30 cryptocurrencies. Choosing the best broker is a noble goal when you’re ready to start investing for retirement (and you should start now if you haven’t already). But coming up with the answer has gotten more difficult — or a lot easier depending on your point of view. The platform is easy to use and it provides enough tools to satisfy newer investors looking to learn on the go, like a Portfolio Builder tool and Wealth Plan dashboard. The biggest asset of the account is that it’s linked to your checking and savings accounts, so you can manage all of your personal finances in one succinct dashboard. Beyond standards like stocks and ETFs, you can add crypto, fine art, luxury goods, and collectibles to your portfolio.

Best Online Stock Trading Sites

None of our partners or advertisers have editorial input or control because our relationship with our readers always comes first. This bid-ask spread capture allows market makers to receive compensation for holding assets if they deviate significantly in value over time. Market makers act as individual market participants or member firms of an exchange to buy and sell securities for their accounts. You will want to be careful about TD Ameritrade for some investment choices. When sorting through the company’s security choices, make sure you filter for no-load ETFs before buying.

It also offers all those investment options with trading fees at the lower end of the entire industry. Its basic trading fees for stocks, options, and ETFs are at the lower end of the investment brokerage fee range, at $4.95 per trade. Mutual fund commissions are $49.95 per trade, but they offer hundreds of funds commission-free. Moreover, trading and non-trading fees should either be the lowest in the market or be within the average if the broker excels at everything else mentioned earlier. They act as intermediaries through which customers can place buy and sell orders that are re-routed to the exchanges where the financial instruments are listed.

The investing information provided on this page is for educational purposes only. NerdWallet does not offer advisory or brokerage services, nor does it recommend or advise investors to buy or sell particular stocks, securities or other investments. Brokerage accounts allow you to purchase securities such as stocks, bonds and ETFs and are a great way to save toward your financial goals. A brokerage account might be used to save and invest for a specific financial goal such as paying for a child’s education, or it may just be used to build wealth over time.

Best for All Levels of Investors

The app is intuitive and easy to use and allows for fast self-directed trading in stocks, ETFs, and cryptocurrency. Robinhood also lets investors buy fractional shares of thousands of stocks, which means you don’t need to have a lot of capital to get started. If you are just starting to invest, you want to find a brokerage that offers a simple onboarding process, low fees, and access to educational content.

To complete our list, we’ve also included a buyers guide to help you understand stock investing, its benefits and risks, and what to look out for in a stock broker as a beginner. If you’re a newcomer looking to take your first step into the world of online stock investing, then you’ll want to know which online brokers will benefit you most and help you succeed as a beginner. The Tokenist aims to bring you the most accurate, up-to-date, and helpful information when it comes to your finance. Some of the products and services we review are from our partners. In order to operate, The Tokenist may receive financial compensation from our partners when you purchase products, services, or create accounts through links on our website.

Firstrade: Best For Retirement Accounts

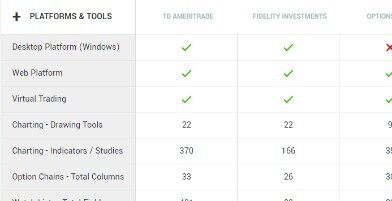

Online brokers offer fast execution speeds and trading costs have been lowered amid an industry-wide push toward zero-commission trading. In this section, we will be discussing the parameters that we have focused on to pick the best online brokers that made it to our list. The research tools provided by Schwab’s platforms are significantly advanced.

Salesforce.com (CRM) Is Considered a Good Investment by Brokers … – Nasdaq

Salesforce.com (CRM) Is Considered a Good Investment by Brokers ….

Posted: Wed, 29 Mar 2023 13:30:00 GMT [source]

That means you can perform all investment activities online, from your home computer, work computer, or even your mobile device. There’ll be no need to visit your broker’s office, and only the occasional need to make a phone call. Stash works much the way Acorns does in that it provides you with a way to accumulate the funds to invest, in addition to investing itself. You can contribute a flat amount to your account at regular intervals, like $5 per week.

Is Gold a Good Investment? – Money

Is Gold a Good Investment?.

Posted: Wed, 29 Mar 2023 13:20:28 GMT [source]

This package charges a monthly subscription fee of $5, and margin rates start at 5%. It provides access to in-depth research reports from Morningstar and Level II market data. The platform offers 45 different technical indicators along with an intuitive search function. It also provides fundamental data on the different securities available to trade.