What Is a Pay Stub? Definition and Key Requirements

Pay Stub Abbreviations are the abbreviations that you come across on any pay stub. There are separate boxes for federal taxes and state or local taxes if they apply. That one usually stumps people who are new to the workforce, but it’s easily explained. You would do some workers a great service by talking them through the sections to explain where a portion of their money goes. If you haven’t used pay stubs in a while, they’re worth brushing up on.

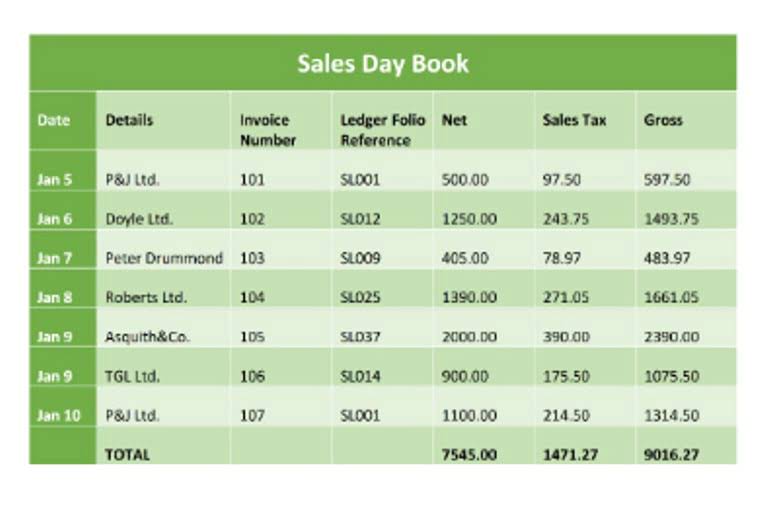

- Each category on the pay stub should have details for the current pay period and running totals of year-to-date earnings, taxes, deductions, additions and net pay.

- This is what the employee takes home when all deductions and additions are said and done.

- Nothing makes employees happier than being paid on time by an employer they trust.

- Of all the details, taxes usually comprise the most significant deductions on the gross pay.

- If you come a cross an abbreviation you don’t understand check out our article on various pay stub abbreviations.

- In theory, your W-2 is simply an aggregate of all pay stubs you received over the year.

- Finally, your paystub can be essential in holding your employer accountable.

When using a paid or free payroll tool, you’ll enter in the required information in each area of the pay stub. Remember that the withholding amounts for taxes must be paid to the correct agency, and these numbers should be double-checked to avoid errors that might cost you penalties. Depending on the size of the deductions, an employee’s net pay may be significantly lower than their gross pay. On the employee’s pay stub, net pay is recorded for the pay period and cumulatively for the year. Gross wages are the full amount an employer pays before deductions. This pay often includes more than the employee’s regular wages.

Why Should I Provide a Pay Stub to Employees and Contractors?

The Fair Standards Labor Act (FSLA) requires employers to keep records of how many hours an employee has worked and the amount of money they were paid. But, it does not require that employers share this information with their employees. You needn’t crunch and recrunch numbers to generate accurate pay stubs.

- Most companies deposit the paycheck directly in the employee’s account so that the paycheck amount is transferred to the employee’s account directly on payday.

- That’s right, most payroll software actually has built-in pay stub generators, also known as professional employer organization (PEO) services.

- Here are a few pay stub examples of professional-looking pay stubs for your reference.

- Separate columns show figures for the current pay period and year to date.

- Create a pay stub for your employees in no time with this easy-to-use template.

- On the other hand, access states like Ohio and Texas require employers to provide a pay stub that are either electronic or paper.

If an employee received benefits or has completed overtime, this should also be included. Paystubs are important because they lay out information about an employee’s wage during a certain period of time. They are useful to help avoid any confusion or disputes regarding pay as they clearly outline where percentages of the wage are being deducted and why. Depending on the locality, different requirements are expected to be met when it comes to paystubs, although generally the same kind of information should be included. Technically speaking, a pay stub is a statement that outlines information about an employee and their payment for a specific duration of time, otherwise known as a pay period.

Understanding Paycheck Stub Deductions

While the above elements are all commonly found on paystubs, they may vary depending on your personal circumstances. For example, you may live in a state that doesn’t collect state income taxes. Or you may be on someone else’s healthcare plan, so you wouldn’t have any benefit deductions on your pay stub. Pay stubs are important documents that give employees transparency in how they are getting paid. It also gives year-to-date information so that the employee can see how they are doing for the entire year.

To create a smooth payroll experience, it’s important to keep your financial records and employee data well organized and secure. Garnishments only apply to employees who are legally obligated to withhold a portion of their earnings by a court. Child support and large debt payments are example scenarios where courts may require this situation. Deductions shows any additional deductions that might be taken out of your paycheck after tax, like group life or disability insurance. The pay stub should also reflect garnished tax or child support payments.

Pay Stub Generator

Traditionally, the pay stub was a paper document attached to a physical check or included in a wages envelope. These can be emailed to employees or made available to them online. In the United States, no federal law requires employers to give employees pay stubs, but many states require them. Details of those requirements vary from state to state, so it’s important to consult with state labor offices, especially if your organization does business in more than one state. You can give your employees an electronic (e-paystub) or paper pay stub.

What is OASDI tax on my paycheck? Why you and your employer pay this federal tax. – USA TODAY

What is OASDI tax on my paycheck? Why you and your employer pay this federal tax..

Posted: Wed, 25 Jan 2023 08:00:00 GMT [source]

Therefore, in order to be compliant with tax laws, independent contractors should invoice the firm which will demonstrate a record of payment. Generally, contractors are not issued with a pay stub as there are no deductions, contributions, or benefits involved when it comes to the relationship between contractor and company. For international pay stubs meaning employers, it is important to be aware of the rules for the countries in which they operate. For instance, in some countries, holiday bonuses, or ‘13th month pay‘ are required by law and in others, holiday bonuses are discretionary. Companies must therefore understand that requirements for paychecks will vary depending on the country.