Accounts receivable days definition

Additionally, using Key Performance Indicators (KPIs) specific to your industry or business can offer meaningful insights into accounts receivable management. For example, if you operate in retail, metrics like sell-through rate or inventory turnover could provide valuable information about customer demand and payment patterns. This approach categorizes outstanding invoices based on their age, typically in buckets such as 30 days, 60 days, and 90+ days past due. By analyzing these categories, you can identify trends and patterns in your collection efforts and take appropriate actions to improve cash flow. In conclusion,

calculating the Days AR Formula is a simple but powerful tool in understanding customer payment behavior and optimizing procurement strategies.

- By calculating this metric, businesses can gain valuable insights into their accounts receivable turnover and efficiency in collecting payments from customers.

- With NetSuite, you go live in a predictable timeframe — smart, stepped implementations begin with sales and span the entire customer lifecycle, so there’s continuity from sales to services to support.

- This ratio is important because it means Apple can effectively ramp up production to the very maximum level of consumer demand and will never be limited by cash flow (not that it would be anyway with $100bn in the bank).

- Your Average Days in Accounts Receivable or “Days in A/R” is the average time that it takes for a service to be paid by a responsible party.

- Calculating your receivable turnover in days helps you see how customers’ average payment times compare with your credit terms.

In many businesses, the days sales outstanding number can be a valuable indicator of the efficiency of the business and the quality of its cash flow. If the number gets too high, it could even disrupt the normal operations of the business, causing its own outstanding payments to be delayed. This calculation does not take into consideration the client behind the account. To supplement this shortfall, it is recommended to use other calculations, such as accounts receivable aging, to get a more complete picture of a company’s collection process.

What Is a Good Accounts Receivable Days Number?

Fortunately, there are alternatives available that can provide valuable insights into your accounts receivable performance. When it comes to measuring procurement success, one key metric that is often used is the Days Accounts Receivable (AR) formula. This formula helps organizations determine how quickly they are able to collect payment from customers. Looking at a DSO value for a company for a single period can provide a good benchmark for quickly assessing a company’s cash flow.

Your DSO ratio tells you how efficiently you’re collecting cash from customers, so the more granular you can get with your calculations, the easier it will be to identify opportunities for improvement. It means your company is able to collect payments from customers quickly after making sales. This can lead to improved cash flow and financial stability, allowing the business to reinvest in growth initiatives or cover operational expenses with ease. It can also indicate a strong handoff from sales teams to customer success as well as strong alignment between you and your customers on pricing and payment processes. On the other hand, a low accounts receivable turnover ratio suggests that the company’s collection process is poor.

How Can a Business Reduce Its Accounts Receivable Days?

Reduce risk and save time by automating workflows to provide more timely insights. Due to the variables that go into the makeup of your facility’s A/R, the days in A/R are most valuable when comparing them month to month in your facility. They show the trend in A/R and allow you to spot issues before they get out of hand. They can be used to compare your numbers to facilities within your market that have similar case/payer mix but are not that much of an indicator when comparing to different geographic or demographic locations. Our company’s revenue growth will be assumed to decline to 2.0% by the end of 2027 in equal increments, i.e. the year-over-year (YoY) growth rate declines by 4.6% in each period.

- If your ASC has been relatively consistent in monthly volume over the past year, your days in A/R should be similar for all three periods.

- For internal purposes, the importance of tracking A/R days is tied to ensuring a company is operating at the highest level of efficiency attainable.

- The result will give you an indication of how many days it takes on average for customers to pay their invoices.

The second step is to apply this proportion to, or multiply it by, the number of days in the period. The outcome will result in an average number of days in the period that it takes to collect outstanding payment from customers. However, it’s important to remember that the accounts receivable days formula is an overall measurement of accounts receivable, rather than a customer-specific measurement. As a result, it’s always a good idea to supplement this metric with other reports, such as accounts receivable aging (a report listing unpaid invoices and unused credit memos by date).

Best Practices for Improving A/R Collections and Management

On the other hand, if the A/R days are much lower than the credit period, the credit terms might be too strict. Collaborative accounts receivable automation software can help businesses invoice faster, proactively manage (and prevent) overdue payments, and address what is often the biggest contributor to late payments—disputes. Our AR management solution automatically calculates your financial ratios – that includes your days sales outstanding. Upflow connects with third-party apps like your invoicing software, so there is no need to keep switching between tables or software to chase the latest data. That’s why most CFOs and finance professionals use this method to calculate their company’s DSO and that’s why you should use it too. Your average accounts receivable balance divided by revenue for the given period, all multiplied by number of days in the period.

Days Sales Outstanding (DSO) is a very similar metric to accounts receivable days. Both are indicative of a similar function within the business, which is to collect payments from customers. More well-defined credit policies, better evaluation of potential credit customers, and a more conservative practice for issuing credit, may help improve collections and lower the number of accounts receivable days. The revenue cycle refers to the entirety of a company’s ordering process from the time an order is placed until an invoice is paid and settled.

The Most Accurate Formula to Calculate your DSO

Before joining Versapay, Nicole held various marketing roles in SaaS, financial services, and higher ed. A high AR turnover ratio generally implies that the company is collecting its debts efficiently and is in a good financial position. To get a more accurate result that factors in your normal yearly ebbs-and-flows of business, you’d have to calculate your DSO for these different periods. Then, you’d compare them against each other to get a loose idea of your cash conversion cycle. A low Days Sales Outstanding (DSO) is generally considered a positive indicator of the health of your accounts receivable process (check out our article on accounts receivable KPIs for other ways to track this). Get a better understanding of when you experience higher DSO trends so you can resolve issues alongside your partners in accounting and customer success.

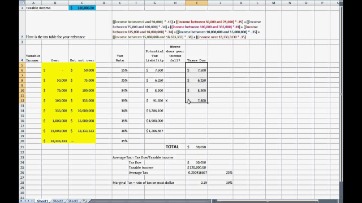

The formula for your days sales outstanding calculation is your average accounts receivable balance divided by revenue for the given period of time, all multiplied by the number of days in the period. In financial modeling, the accounts receivable turnover ratio (or turnover days) is an important assumption for driving the balance sheet forecast. As you can see in the example below, the accounts receivable balance is driven by the assumption that revenue takes approximately 10 days to be received (on average).

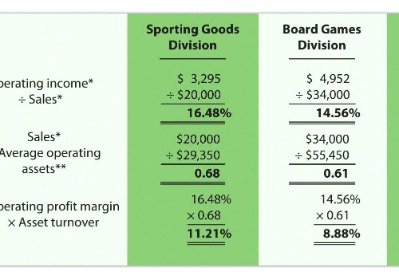

Interpretation of Accounts Receivable Turnover Ratio

With Versapay, you can deliver custom notifications automatically and direct customers to pay online, eliminating much of your team’s need for collections calls. A platform like Versapay that supports omni-channel invoicing lets your customers access their billing details in whichever format suits them best—be it email, customer portal, EDI, accounts payable portal, or even paper. Delivering invoices in a more convenient format also increases customers’ likelihood of paying you faster, improving your collection efficiency. This metric shows how much revenue is lost due to factors in the revenue cycle such as uncollectible bad debt, untimely filing, and other noncontractual adjustments.

G20 – China’s obstructionist approach – msnNOW

G20 – China’s obstructionist approach.

Posted: Mon, 04 Sep 2023 07:43:55 GMT [source]

In these cases, it’s more helpful to pay attention to accounts receivable aging. By automating your collections workflows with AR automation software, you better your chances a guide to nonprofit accounting for non of getting paid on time, substantially improving your accounts receivable turnover. A high receivable turnover could also mean your company enforces strict credit policies.