Income Statement Example Template Format How to Use Explanation

Content

Another insight the what is an income statement statement can provide is whether your company is efficient in the way it spends money, which is becoming increasingly important in this economic climate. If you’re still struggling with multiple accounting ledgers, be sure to check out The Ascent’s accounting software reviews and get ready to leave those ledgers behind. The preparation and presentation of this information can become quite complicated. In general, however, the following steps are followed to create a financial model. These three financial statements are intricately linked to one another.

Your pro forma salaries for next year will be $210,000 and your pro forma expenses will be $105,000. You then figure your pro forma total expenses by adding pro forma salaries and pro forma other expenses together. In our sample case, your pro forma total expenses will be $315,000. Cash flow from investing includes cash received from or used for investing activities, such as buying stock in other companies or purchasing additional property or equipment.

Want More Helpful Articles About Running a Business?

It is called the single-step income statement as it is based on a simple calculation that sums up revenue and gains and subtracts expenses and losses. Finally, owner’s equity is the amount of money currently invested in the company and includes any retained earnings. Unlike an income statement, a balance sheet reports on company assets, liabilities, and equity as of a specific date, not a specific time frame. Operating Income represents what’s earned from regular business operations.

Fixed-income analysts examine the components of income statements, past and projected, for information on companies’ abilities to make promised payments on their debt over the course of the business cycle. Corporate financial announcements frequently emphasize income statements more than the other financial statements. The income statement presents information on the financial results of a company’s business activities over a period of time. The income statement communicates how much revenue the company generated during a period and what costs it incurred in connection with generating that revenue. The basic equation underlying the income statement, ignoring gains and losses, is Revenue minus Expenses equals Net income.

Products

After preparing the skeleton of an income statement as such, it can then be integrated into a proper financial model to forecast future performance. Add together everything listed in your losses section of your income statement to get your total losses. Write the total on the next line of your statement so you can easily find it later. The fourth section calculates net income, or the money you’ve made in profit after subtracting your expenses from your revenue. On the line directly beneath the company name, write “Income Statement.” On the next line, write the period of time that the income statement covers. Businesses that are publicly traded must generate income statements on quarterly and annual basis to file with the Securities and Exchange Commission.

How do you prepare an income statement from a trial balance?

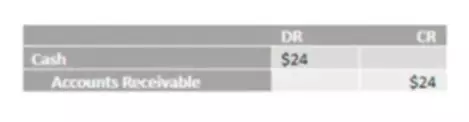

A trial balance is a list of all debits and credits from a double-entry general ledger. Income statements can be created manually using this tool, but automated accounting systems have eliminated the need for doing the work yourself. Systems like Quicken and NetSuite compile the trial balance for you and run your reports based on those numbers.